Guide to protection and intergenerational wealth

Using protection to safeguard intergenerational wealth

At first glance, protection can offer a valuable safety net if a policyholder becomes critically ill, is unable to work due to illness or injury, or when they pass away.

But protection products can also help to provide a legacy, whether directly by way of a life insurance payout, or indirectly such as through income protection.

While clients’ objections to taking out cover can include plans to fall back on savings or family members, or even to sell their home, such methods can deplete assets that a policy could preserve.

As Rob Harvey, protection product specialist at Protection Guru, explains: “A lot of people wouldn’t necessarily think of IP as something that you would use to protect your assets and to effectively protect the wealth of your future generations.

“But if you think about it in terms of what it’s designed to do, it does protect their assets.

“We published a claim story recently about someone who claimed for 35 years; that’s effectively 35 years that they’ve had financial support from an insurer, rather than having to use all of their own assets. The benefit is they’re effectively protecting their savings.

“If they’ve got a property, they’re not having to sell it to release funds, or remortgage. They’re preserving their own wealth to pass on.”

Critical illness cover is another policy that can help to protect assets for inheritance, adds Harvey.

“A lot of people buy it to protect, say, a mortgage debt. If that person suffered a very serious illness that resulted in a payout on a CI policy, the mortgage debt is paid off, and then they own that property outright, which they can pass on to their children.

“If you’re having a conversation with a client about leaving a legacy or protecting their assets, I think there’s a temptation to immediately turn to some of those life products in particular, and maybe lose sight of things like IP and CI.”

Writing a protection policy in trust

For those that do opt for life insurance, Paul Reed, director at protection specialist Vita, emphasises the importance of writing the policy in trust.

“That has to be up there as a real key component of any protection planning, because if it’s not written into trust, then that could leave their loved ones in a very difficult situation of policy proceeds being tied up in probate, or maybe not reaching the right people that they wanted it to go to.”

Harvey agrees that writing a policy in trust is something that should almost always happen.

“Writing a life insurance policy in trust also ensures the money is paid out that much quicker, because you’re not having to wait for that process of probate in order to access those funds.

“Where that’s really important is if there’s a debt or something that needs to be repaid, such as a mortgage. A delay in getting that money paid out can obviously have very serious consequences and particularly so for unmarried couples.”

An executor or administrator will usually receive the grant of probate or letters of administration within eight weeks of applying, according to the government’s website. It also advises executors and administrators that they should not make any financial plans, or put property on the market, until the grant of probate or letters of administration have been received.

And because any inheritance tax must normally be paid before probate can be issued, Justine Shaw, senior adviser and protection specialist at LifeSearch, warns that without forward planning this can sometimes see families taking various types of loans to see them through.

“Life insurance policies that are not written into trust may end up forming part of the estate, which means they are included in the IHT calculation,” Shaw adds.

Of the 22,100 estates that paid IHT in 2018-19, the average bill was £209,502, according to analysis of HM Revenue & Customs statistics by NFU Mutual. More than a quarter of these estates (6,040) included life insurance policies.

The policies were worth £709m in total, the provider adds, meaning that more than £280m of IHT may have been paid “unnecessarily”, as many would have escaped a bill if their policy was written into trust.

The payout from a protection policy that is placed in trust could also be used to pay an IHT bill itself.

Mike Donohoe, strategic development director at broker Caspian Insurance, highlights the potential for an estate to dwindle “generation by generation” if funds are not available to pay any tax liabilities.

Donohoe gives the example of a married couple whose estate value is above the tax-free threshold, with two children as beneficiaries and IHT payable at 40 per cent.

“Forty per cent would go to HMRC, and the children would get 30 per cent each. So the biggest beneficiary of your estate could be HMRC.

“Making sure that you keep as much financial proceeds outside of your estate on death is critical. And the best way to do that is to place your policies into the right trust form.”

Ensuring financial security for clients during the worst of times

Critical illness cover and income protection can both provide financial support in instances of bad health.

CI cover will typically pay a lump sum if the policyholder is diagnosed with a condition from a specified list, while IP will pay a regular income if they are unable to work due to an injury or illness.

Of the two policies, IP is often overlooked in favour of CI cover despite providing broader cover, says Rob Harvey, protection product specialist at Protection Guru.

“You’ve got that broad coverage where, essentially, if you’re unable to work because of any illness or injury then IP will pay out,” he explains, while CI cover generally requires a specific illness to be diagnosed when making a claim.

Mike Donohoe, strategic development director at broker Caspian Insurance, says a common misconception among people is that if they were unwell and unable to work, this would be caused by a serious illness such as cancer, a heart attack or stroke.

Emma Thomson, head of protection and general insurance propositions at Sesame Bankhall Group, agrees that losing an income due to work absence is more common than people may think.

“For example, according to LV’s risk reality calculator, a 32-year-old non-smoking male has a 39 per cent chance of being off work for two months or more before the age of 70.

“A 32-year-old smoking female has a 58 per cent chance of being off work for two months or more before the age of 70. That compares with only a 7 per cent and 14 per cent chance of death respectively.”

Thomson adds: “Aviva also reported that the average length of an IP claim last year was six years and 11 months, just demonstrating how long some people need to claim for.”

For those who may be hesitant to take out IP, one option could be to opt for a longer deferred period to suit the individual’s circumstances.

As Justine Shaw, senior adviser and protection specialist at LifeSearch, explains: “When you buy IP you choose a deferred period, which is the amount of time you are ill for before the money starts paying out.

“It is possible to choose one week or one month, which means relatively short-term injuries or illnesses could be covered, such as a broken arm or strained back.

“Alternatively to reduce the cost and/or to fit in with any existing employer cover or savings, the deferred period could be three, six or 12 months where longer-term conditions would be covered, potentially until retirement age as long as you are still unable to work.”

Reasons for workplace absence

Some of the most common reasons for sickness absence last year were mental health conditions, such as stress, depression, anxiety, and musculoskeletal problems, including back pain, neck and upper limb problems, according to the Office for National Statistics’ labour force survey.

Thomson highlights Aviva’s claims report that likewise shows musculoskeletal and mental health conditions were the two most common reasons for new IP claims, at 53 per cent last year.

Harvey at Protection Guru says: “If you look at those two common reasons for workplace absence, and you then look at CI insurance policies, they’re two things that are not really covered by a CI plan.

“CI policies will, of course, cover really serious things like paralysis or amputation of limbs, and on the mental health side it will cover very serious mental health conditions, but it doesn’t cover those common things that are causing people to take time off work.”

While it does not take a terminal illness for someone to find themselves unable to work, in general the risk of cancer is still high. One in two people in the UK will be diagnosed with cancer in their lifetime, according to charity Cancer Research.

Despite the odds, Harvey says that people do not tend to predict that they will get cancer.

“It’s very easy, I would argue, to find yourself in a position where your ability to earn is impacted. That could be something very serious and life-changing like a cancer diagnosis, but equally it could be something like experiencing an episode of bad back,” he adds.

Donohoe at Caspian Insurance says another misconception is that if you work from home, the risk is reduced.

He continues: “But what customers need to think about is not just are you able to work, but do you want to recover? And how long will it take you to recover if you have to carry on working as well, as opposed to being able to rest and get the recuperation support that you would get with an IP policy?

“It might be additional physiotherapy or counselling that would help your recovery, and mean that you’re back to work and back to 100 per cent in your life much quicker.”

Cover for clients’ children

A CI policy can ease any financial worries at an already difficult time that clients or their children may be facing.

Phil Jeynes, director of corporate strategy at broker Reassured, highlights how most CI plans cover the policyholder’s children automatically, to pay a lump sum if they were to fall ill.

“This can be used to cover medical bills, or simply to fill a gap in income while a parent takes time off to care for a youngster. Usually the child doesn’t have to be underwritten or named – they’re covered even if they’re born after the policy starts,” adds Jeynes.

IP could also provide an element of cover if the policyholder’s children fell ill.

LV’s policy, for example, includes parent and child cover that pays a lump sum equal to six times the amount of cover if the policyholder’s child is diagnosed with a specified illness.

Thomson at Sesame Bankhall Group also points to IP policies from providers such as AIG and Zurich, which offer cover for carers and enable parents to take time away from work if their children become ill and need full-time care.

Children can typically be covered by their parent’s CI policy until their early 20s, but the benefits of having protection do not necessarily have to end there.

Alun Beynon, head of intermediary protection distribution at Scottish Widows, cites the provider’s claims data showing 44 per cent of CI claims occurring between the ages of 31 and 50, yet only 9 per cent of 18 to 34 year olds having CI cover.

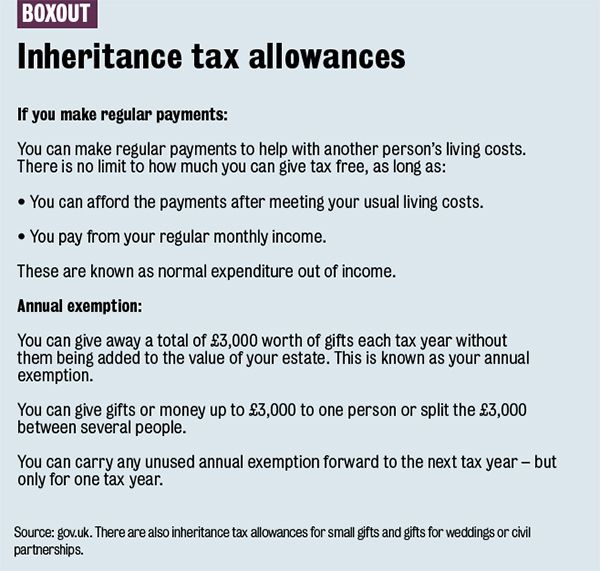

Paying for protection policies on behalf of adult children is a good way for clients to ensure their children are well catered for if they suffer a period of illness, and it can be a useful way for the parents to utilise their inheritance tax exemptions, says Ian Dyall, head of estate planning at Tilney Smith & Williamson.

“Paying the premiums of a protection policy on behalf of their children would be seen as making a transfer to them for IHT purposes. However, that transfer may be covered by either the normal expenditure from income exemption or the annual exemption.”

Clients paying for a CI or IP policy, or both, for their adult children could also help to address the so-called protection gap.

“A lot of the triggers that might traditionally have meant that people seek advice or speak to someone about protection insurance have gone,” says Protection Guru's Harvey.

“People are getting on the housing ladder a lot later in life, they’re not having conversations with a mortgage broker until they’re a lot older. I think parents having the protection conversation can ensure that a huge chunk of people end up getting protected that maybe wouldn’t otherwise have done.”

Maximising intergenerational wealth in the face of inheritance tax

Less than one in 20 UK deaths (3.7 per cent) resulted in an inheritance tax charge in the 2018-19 tax year, with the average liability at £209,000, according to IHT statistics.

To put that figure into context, the median annual pay for full-time employees was £31,461 for the tax year ending April 2020, according to the Office for National Statistics.

The liability is therefore equivalent to more than six years’ worth the median pay in the subsequent tax year.

But provider NFU Mutual says the percentage of deaths resulting in an IHT liability is expected to rise, following the chancellor’s decision to freeze IHT thresholds until April 2026.

Potentially exempt transfers

If a gift is made during a lifetime, it can be considered a potentially exempt transfer, so that IHT is not payable when it is made.

But a potentially exempt transfer becomes chargeable if the donor passes away within seven years, so that IHT could be payable if the gift caused the tax-free threshold to be exceeded.

“The moral of the story is that being bold and making significant gifts sooner rather than later can be rewarding, but only if you have assets you do not need,” says Camilla Bishop, estate planning partner at Keystone Law.

If a donor does pass away within seven years of making a gift and IHT is payable, a gift inter vivos plan would enable clients to protect their beneficiaries from any potential IHT liability on a gift they make, says Chris Dunne, protection proposition manager at Scottish Widows.

“A gift inter vivos assurance plan allows the set up of individual policies, which collectively aim to provide a lump sum to cover the potential IHT liability that could arise for the person who has received the gift, if the donor dies within seven years of making the gift.”

Mike Donohoe, strategic development director at Caspian Insurance, adds: “These policies are designed specifically to mirror the tax liability on a gift made by an individual.

“Because it’s a short-term policy, the cost is very competitive against the potential value of the tax bill from HMRC if anything should happen to the individual in that seven-year time period.”

Trusts and IHT

Transfers into a bare trust – where the assets are held in the name of a trustee but go directly to the beneficiary with a right to the trust’s assets and income – may also be exempt from IHT, provided that the person making the transfer survives the next seven years.

Transferring assets into other types of trust can also lead to IHT savings. The transfer into trust – a ‘transfer of value’ – is immediately chargeable to IHT at a rate of 20 per cent for amounts above the nil rate band, says Bishop at Keystone Law.

“This is why most transfers into trust are limited to £325,000 per person, or £650,000 for a couple, to avoid the lifetime 20 per cent charge,” Bishop adds.

“If you live seven years from the transfer, it falls out of account for IHT. If you die within seven years of a transfer into trust, the 20 per cent rate will be topped up to 40 per cent, but only on amounts over the nil rate band.”

A benefit of a trust over a potentially exempt transfer is that control is retained through trusteeship, notes Bishop.

For example, trustees can decide how the funds are invested, who receives the capital and income, and when.

“This offers valuable asset protection from divorce, bankruptcy, etc. of the beneficiaries,” says Bishop. “Often, the trust is a family trust for children and descendants, allowing wealth to be passed on tax-efficiently and carefully to future generations.”

How much control the trustees have depends on how the trust is set up.

Most trusts that are set up for tax planning or asset protection purposes will be fully discretionary, says Bishop, which gives the trustees broad powers over the trust assets.

“It is possible for trusts to be written in more restrictive terms with ‘rights to income’ and ‘specified shares of capital’, thus limiting the flexibility that the trustees have. It is down to the individuals setting up the trust as to what their aims and objectives are.

“It is very difficult to see into the future, so the best advice is often a careful choice of trustees but allowing full discretion over capital and income payments. It is important that settlors set down their wishes in writing to give good guidance to the trustees through a letter of wishes.”

Ian Dyall, head of estate planning at Tilney Smith & Williamson, likewise says that a discretionary trust is the most common type for new protection policies put in trust.

“Discretionary trusts generally have an extensive list of different classes of beneficiary and the trustees have discretion over who they appoint the trust assets to and when they appoint them. This gives flexibility to adapt to any changes, such as the death of a beneficiary.

“Sometimes absolute trusts are used. An absolute trust has named beneficiaries who are absolutely and irrevocably entitled to the assets. The beneficiaries cannot be changed.

“If this type of trust is used, it is important that the beneficiaries have a will to ensure that if they predecease the settlor, the rights to the proceeds of the life policy do not end up in the wrong hands, for example, back in the life assured’s estate via the rules of intestacy.

“It is important that the settlor is excluded from benefit in any trusts used, otherwise a reservation of benefit will be created, and the sum assured will form part of their estate on death.”

As well as fixed beneficiaries, Bishop says it is possible to have a narrow or wider class of possible beneficiaries.

“Settlors need to consider who they are trying to benefit and whether they wish the possible beneficiaries to evolve over time.

“Often, family trusts are restricted to the bloodline with very limited ability to deviate from this, giving settlors peace of mind that the trust will benefit only the family now and in the future.”

How protection can benefit both clients and advisers

Talking about protection may not necessarily be an enjoyable conversation for a client, given that it can involve thinking about worst-case scenarios. Counter-arguments on the need for protection can also arise.

The most common objections to income protection compiled by The Exeter include: “I can’t afford it”, “I’ve got savings to see me through” and “I’ll rely on state benefits”.

But without adequate protection in place, the circumstances that a family might find themselves in can deteriorate very quickly, says Rob Harvey, protection product specialist at Protection Guru.

“I reflect on some of the claims that I dealt with when I was advising, and imagine a counter-scenario where that person didn’t have a policy in place. You start to see and realise how bad things would have been, because they simply wouldn’t have had the money to juggle and balance all of those outgoings.”

Besides the benefits that clients gain from protection, there are also secondary benefits for advisers’ businesses.

Chris Dunne, protection proposition manager at Scottish Widows, says diversifying into protection advice can build sustainability into advisers’ businesses, if protection is not their main focus, through an additional income stream.

And engaging clients’ children in a conversation about protection has the potential benefit of addressing their insurance needs as well as maintaining a future relationship with the next generation.

“From the adviser’s point of view, while their client – the parent – is still alive, there probably isn’t a need to necessarily have conversations with their children about wealth and retirement planning because of their young age,” says Harvey.

“But there is an opportunity to have a protection conversation with them and to effectively start to build a relationship with the children, so that when the parents pass away and pass down any wealth to their children, the adviser already has a relationship with those children from having discussed protection with them.”

Demonstrating the value of protection with living benefits

Value-added services, or living benefits, likewise bring advantages to both clients and advisers, and can include access to digital GP appointments, second medical opinions and mental health counselling.

“This type of additional benefit demonstrates the worth of a protection policy beyond the core purpose and will make cancellation and the associated clawback of commission less likely. It is a benefit to both client and adviser,” says Phil Jeynes, director of corporate strategy at Reassured.

Although value-added services can be seen as additional perks, Harvey at Protection Guru says they are increasingly becoming central to the core cover itself.

“Advisers don’t want their clients to die, fall seriously ill or find themselves out of work – that’s the scenario that you don’t want to have happen,” adds Harvey. “But those added-value services are giving those clients access to services they will use, and they may use them quite frequently.”

When it comes to group protection, Mike Donohoe, strategic development director at broker Caspian Insurance, says clients sometimes even choose the provider based on which one offers the better value-added services.

“It becomes even more important because you are providing a benefit for a bigger number of people in one go. But normally, you look at balancing three things; the quality of the policy is first and foremost. Price is always important, but also those additional benefits that you get are kind of the third spoke in the wheel of making a decision on which insurer is best for you.”

For advisers, Harvey also says value-added services can help cultivate long-term clients and ensure that business “sticks" following an initial impetus to buy protection.

“It might be that they’ve had a family friend fall ill or they’ve just bought a house. But of course there is a risk that each month they’re seeing that premium go out of their account and they’re thinking, 'This is money I’m spending but I’m not using it. I feel in good health, I don’t feel like anything’s going to happen to me'. So there’s a risk that those policies will then over time lapse.”

Harvey adds: “If you’ve got an insurer that offers unlimited use of virtual GP services, and a client with children who ends up using the services three or four times a year, hopefully they’ll realise that by being able to access that by having a protection policy, they’ve seen some real value there.

“When they’re looking at their bank statement each month and seeing say, £50 go out for an insurance premium, they hopefully won’t think, ‘That’s money wasted, I’m not using that’, but rather, ‘That pays for the GP appointments I used’.”

Emma Thomson, head of protection and general insurance propositions at Sesame Bankhall Group, agrees that added-value services can help consumers feel they are getting value for money for something that they ultimately never want to be in a position to claim on.

“Vitality has made this a key part of their proposition, with a wide range of rewards and healthcare benefits such as gym discounts, weight loss programmes, medical screenings and retail offers to ensure policyholders can make use of their cover every day if they want to,” says Thomson.

“Others such as AIG, Royal London and Aviva have focussed on areas such as counselling, physiotherapy, virtual GP and second medical opinion services. These services can boost the support offered by the NHS to help policyholders get treatment before things become too serious.

“They’re also used as part of the claims experience in addition to the payout itself, to assist with rehabilitation. They can be hugely valuable to policyholders themselves, but they also help advisers to demonstrate how protection insurance provides support in times of real need.”

Besides the commercial benefits of advising on protection, Jeynes at Reassured says an onus remains on all financial services professionals to encourage clients to consider protection.

“There is little point planning a smart investment strategy if it can be wiped out in an instant, should the customer fall seriously ill and need to access their cash. Similarly, a mortgage client will struggle to get their next loan if they’ve been in arrears due to time off work that impacted their income.

“At the very least, customers should be signposted to a protection specialist if the originating adviser doesn’t feel able to offer protection.”